Parking Lot Resurfacing Capitalize Or Expense

For more details on current vs.

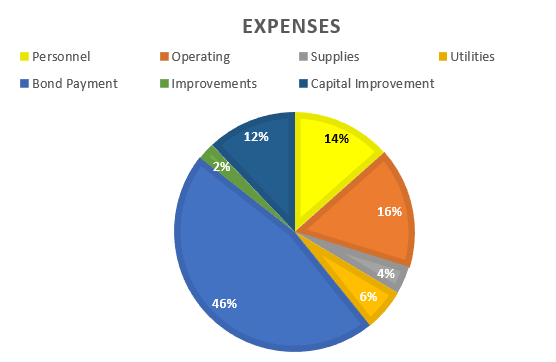

Parking lot resurfacing capitalize or expense. Capital expenses refer to the article current vs capital expenses. Thus we would treat the parking lot sealing repair work as an expense and capitalize the re pavement work. If the lot was partially paved and only parts need to be replaced then you likely have sufficient basis to treat it as an expense. 103 106 1926 the court ex plained that repair and maintenance expenses are incurred for the purpose of keeping property in an ordinarily efficient operating condition over its probable useful life for the.

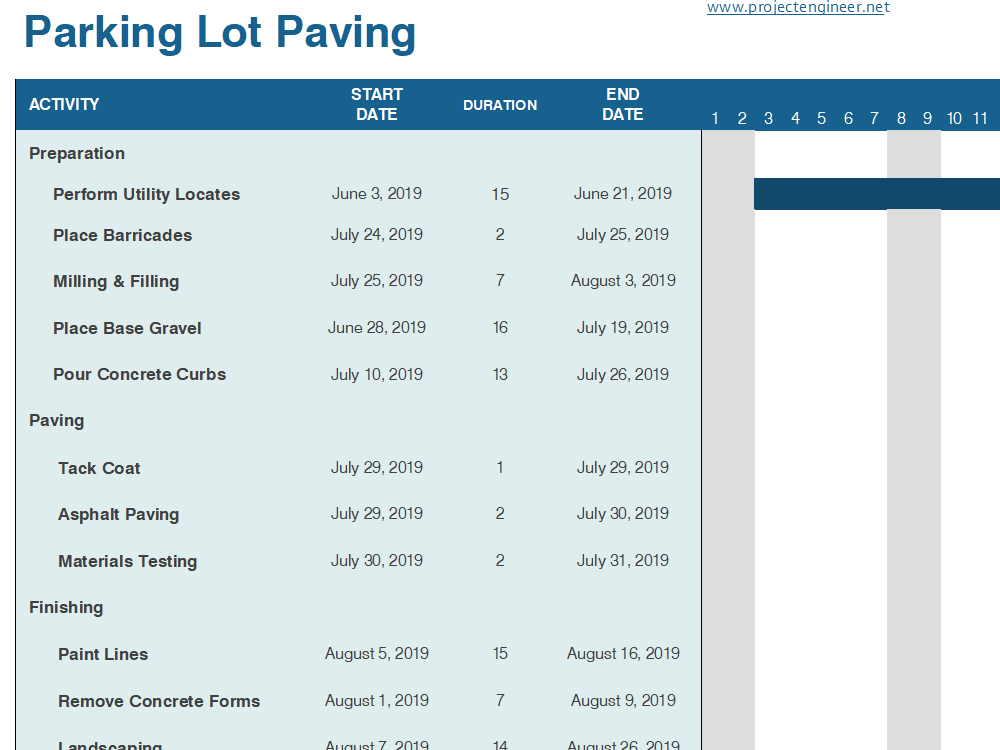

If the repaving is a repair of an existing surface then it can be a repair. Although some of these activities such as resurfacing a parking lot or replacing portions of concrete in a parking facility may be capitalized for book purposes the activities may be considered otherwise deductible. Repairs and maintenance can be expenses fully in the year they are paid for. You may often find yourself asking the question how do i distinguish a capital purchase from a repair expense.

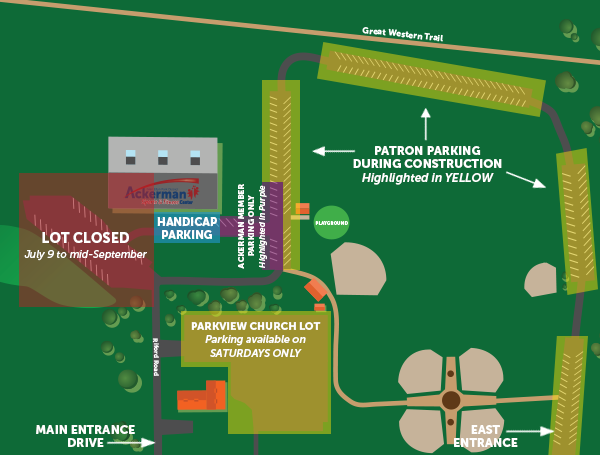

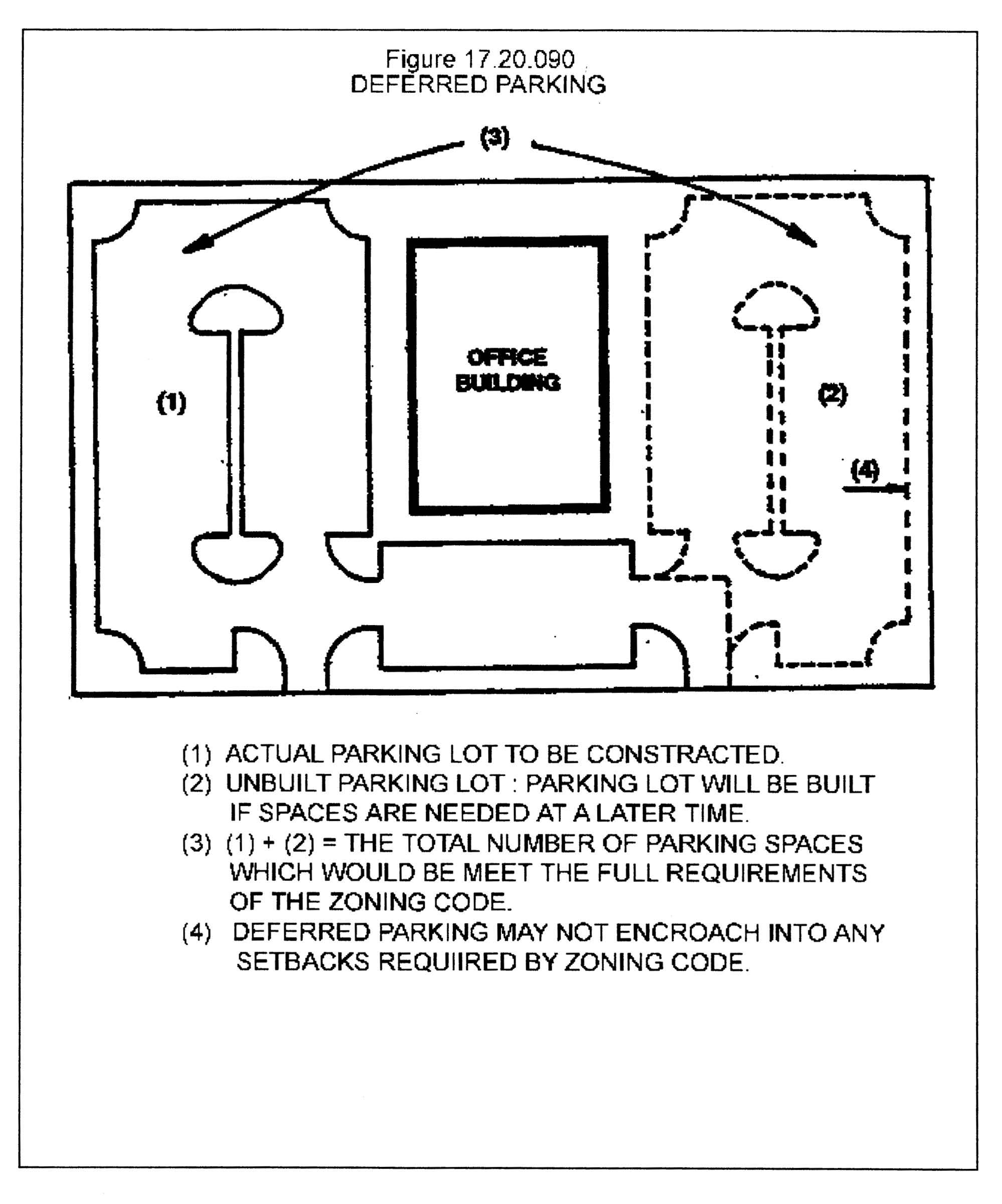

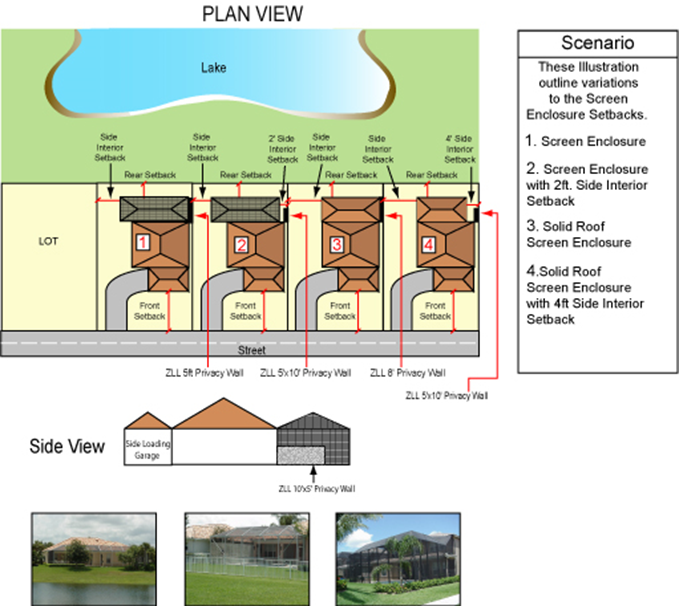

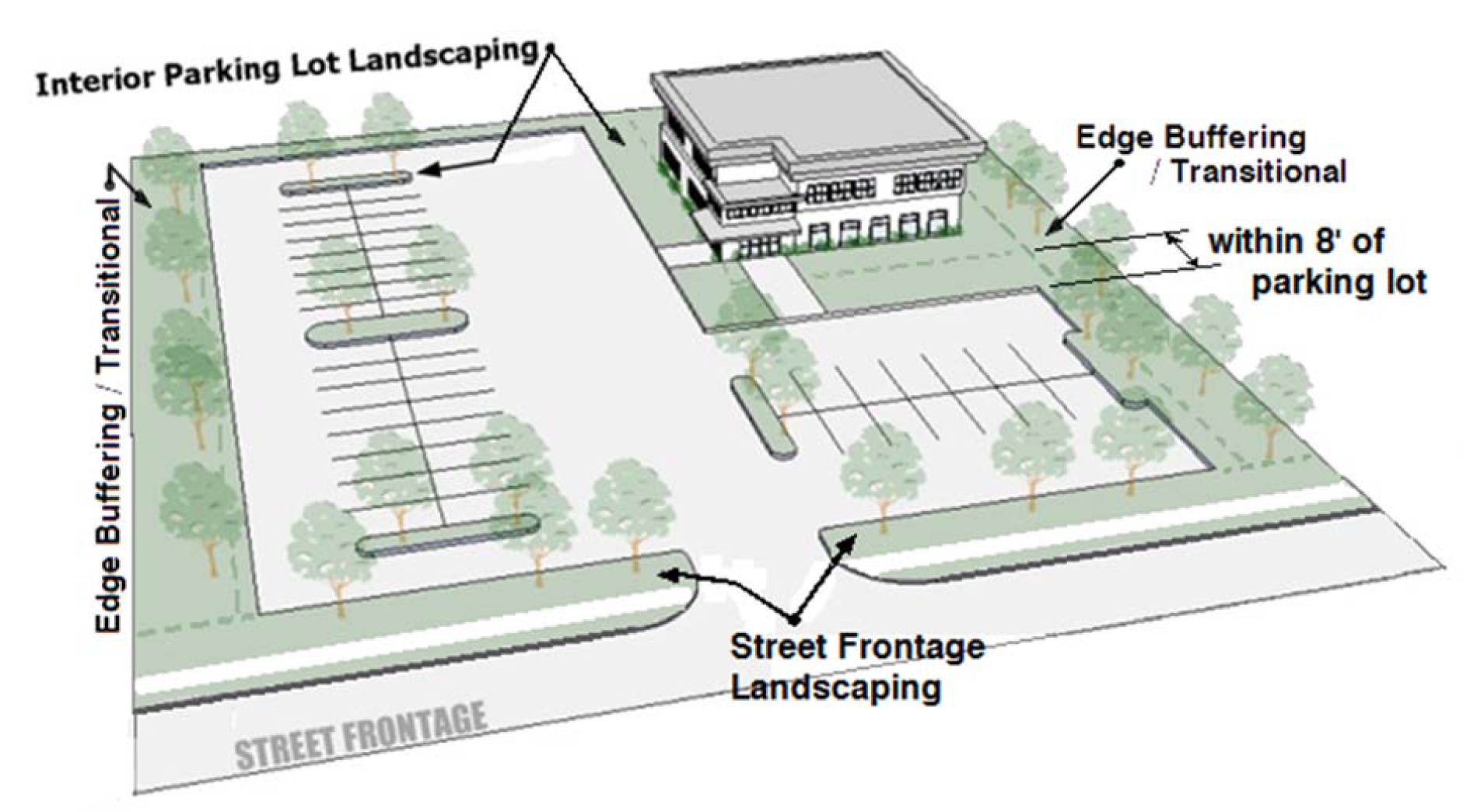

Deductible repairs and non deductible capital improvements. In an attempt to clarify matters the irs issued lengthy regulations explaining how to tell the difference between repairs and improvements. Well on december 23. Category includes bumper blocks curb cuts curb work striping landscape islands perimeter fences and sidewalks.

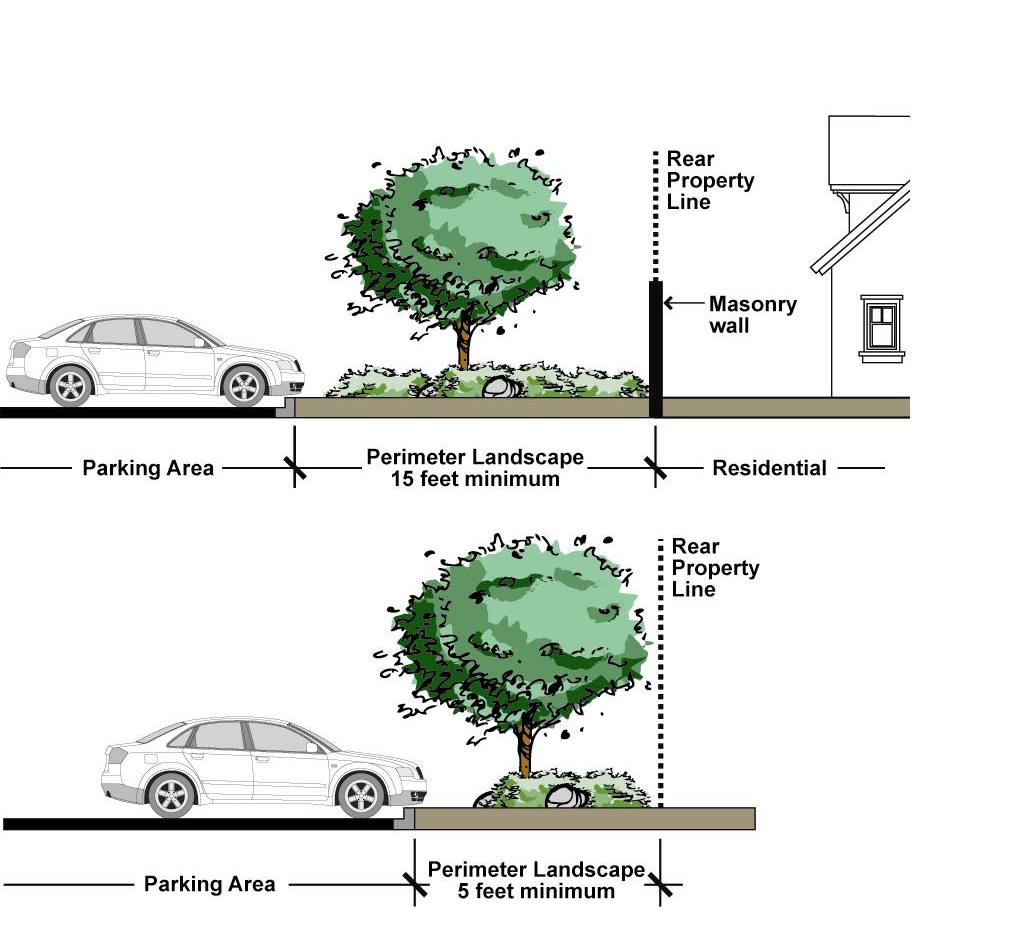

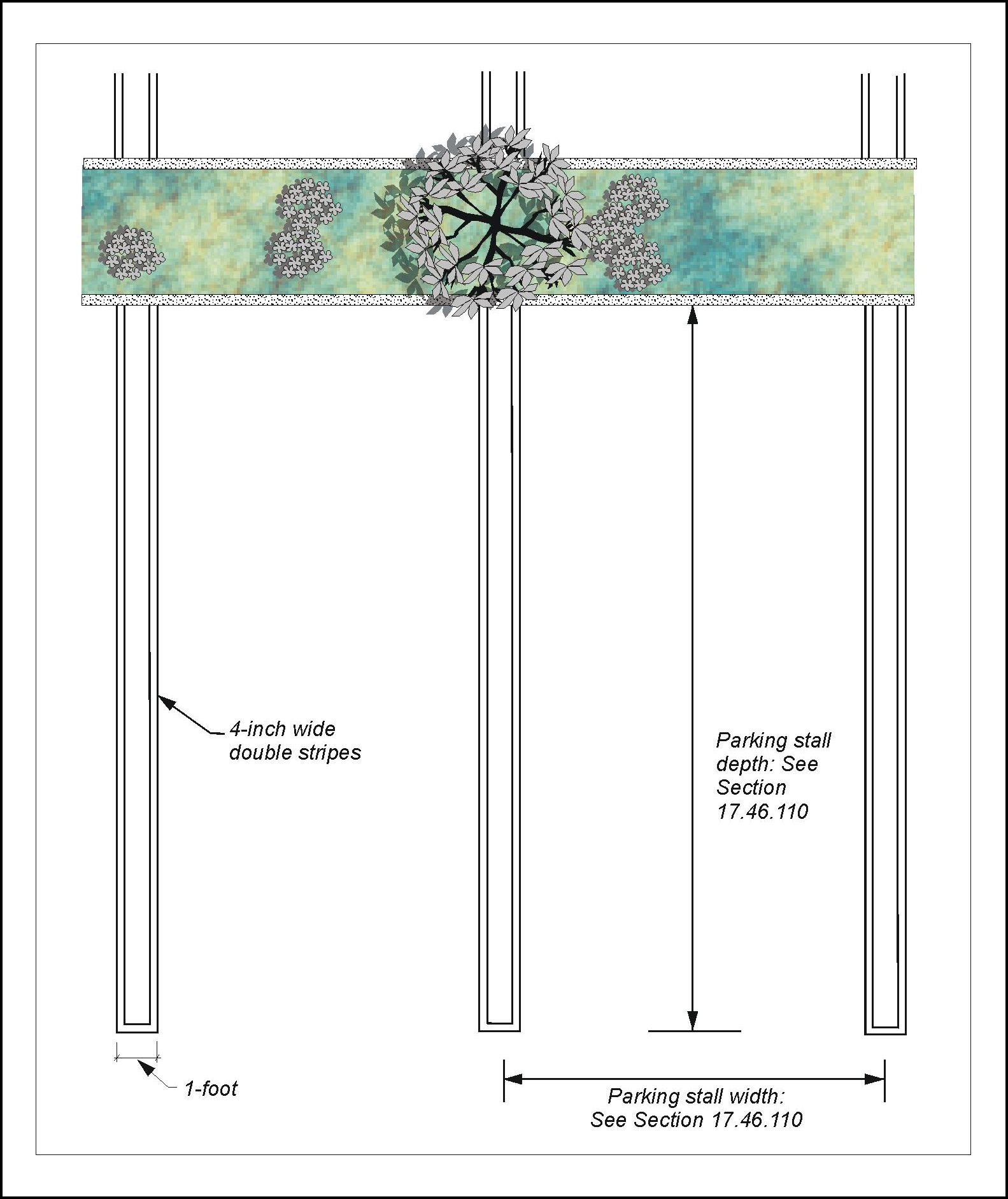

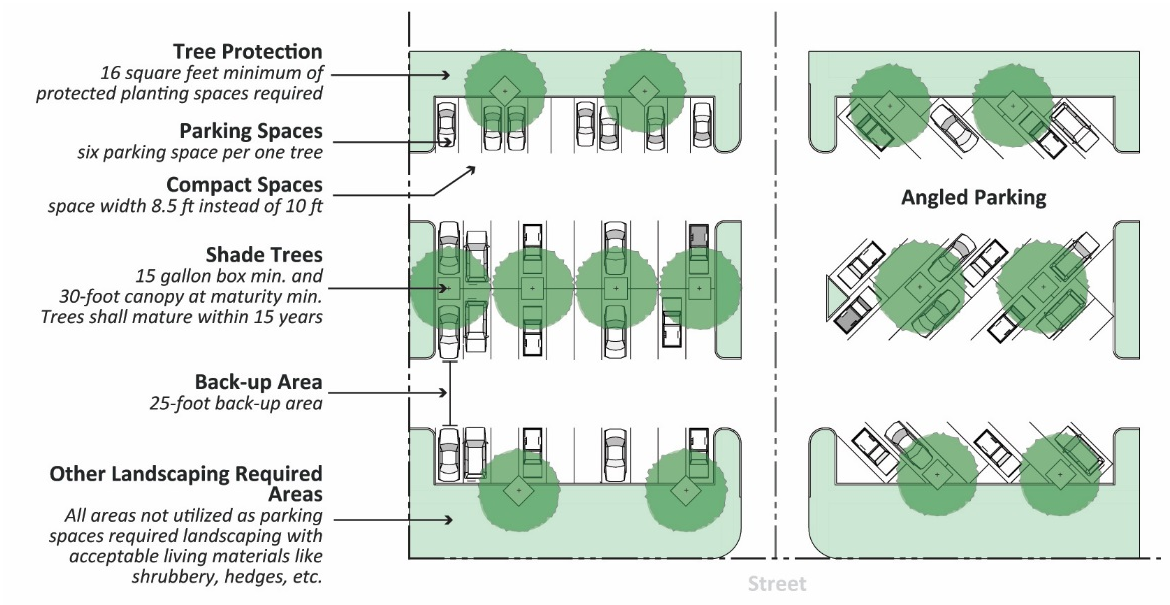

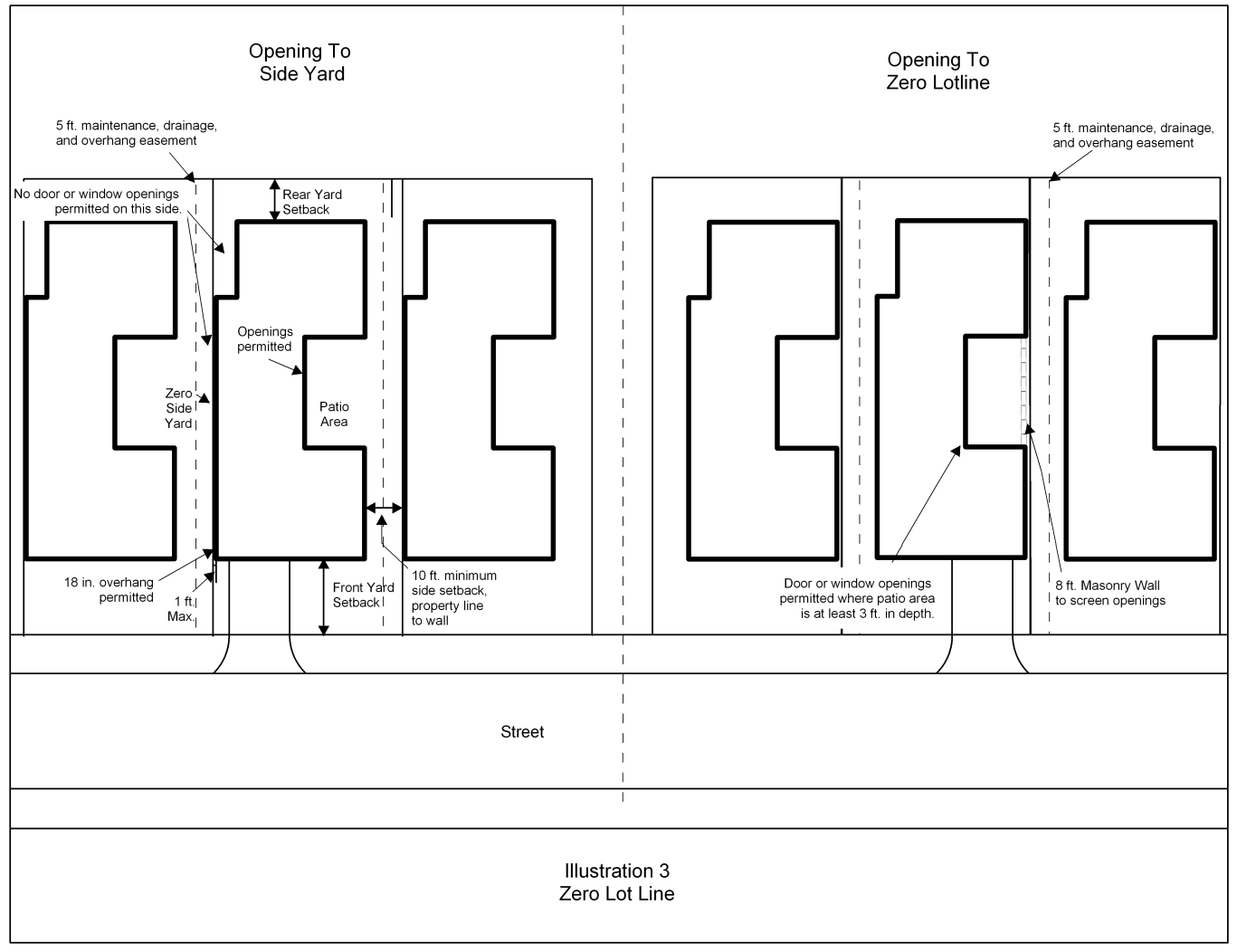

Grade level surface parking area usually constructed of asphalt brick concrete stone or similar material. On the other side the entire cost of a repair and maintenance expense such as fixing broken windows can be immediately deducted on your taxes leaving more money in your pocket by increasing your after tax income. Any replacement work would generally be capitalized and depreciated over time. There has been much debate and controversy not to mention a number of court cases regarding whether or to what extent the amounts paid to restore or improve property are capital expenditures or deductible ordinary and necessary repair and maintenance expenses.

Illinois merchants trust co. 00 3 land improvements 15 years. This policy sets a threshold above which qualifying expenditures are capitalized as fixed assets and depreciated. Of particular significance to the parking industry are the improvement rules.

Parking facilities routinely undergo repairs. If this was an improvement then it can be treated as a capital expense and added to the cost basis and depreciated over time. Nationwide service 877 525 4462 kbkg com cop 2018 ll served llv 8202018 kbkg repair vs. Kbkg expressly disclaims any liability in connection with use of this document or its contents by any third party.

Improvement decision tree final regulations considering the appropriate unit of property uop does the expenditure last updated 03 20 2015. It may also extend the time of the depreciation deduction for several years. Expenditures below the set amount are charged to expenses when incurred. A capital improvement will add value to your property.