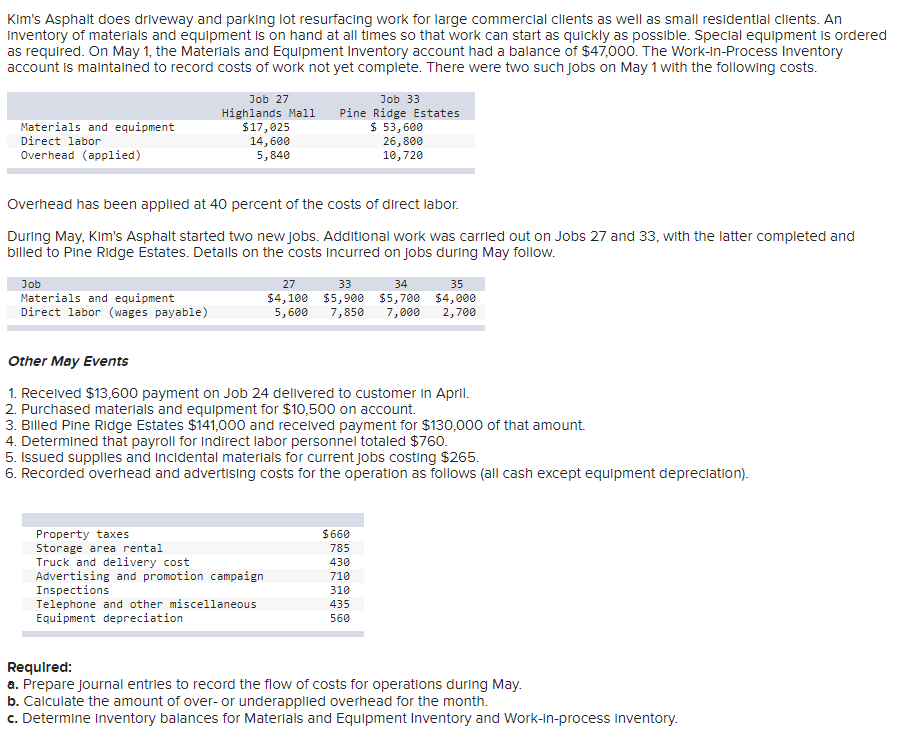

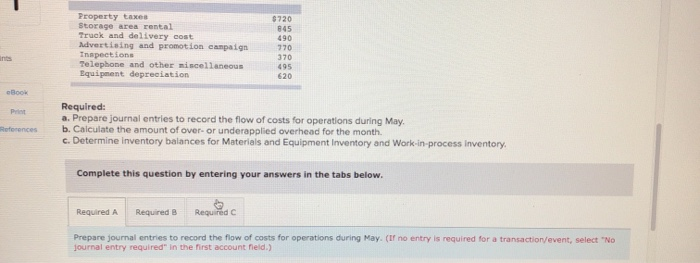

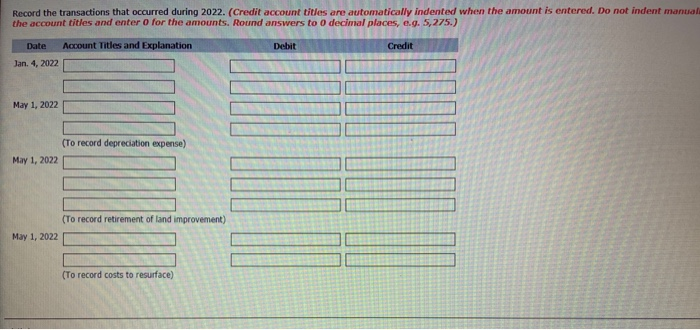

Parking Lot Resurfacing Depreciation

If you classify it as an improvement you have to depreciate it over 27 5 years and you ll get only a 350.

Parking lot resurfacing depreciation. Thus we would treat the parking lot sealing repair work as an expense and capitalize the re pavement work. Since the property will not be finished until 2018 the parking lot would be placed in service in 2018 and subject to bonus depreciation of 40. Repairs and maintenance can be expenses fully in the year they are paid for. Can a parking lot depreciation be deducted on taxes.

See chapter 5 for information on listed property. If this was an improvement then it can be treated as a capital expense and added to the cost basis and depreciated over time. However if the carpet is installed in december 2017 the carpet would be subject to the new rules and eligible for 100 bonus depreciation. I added a land improvement asset and tt calculated 750 for my expense yes i am still doing my 2015 taxes.

On a parking lot that the taxpayer reasonably expects to perform more than once during the alternative depreciation system class life are deemed repairs. A business owner can take a depreciation off his taxes for a paved driveway he put in to improve his facilities. Depreciation for property placed in service during the current year. 1 2016 bonus depreciation is.

If the repaving is a repair of an existing surface then it can be a repair. I added a 15 000 parking lot late last year sept. The bonus depreciation percentage is 50 percent for property placed in service during 2015 2016 and 2017 but then phases down to 40 percent in 2018 and 30 percent in 2019. The macrs asset life table is derived from revenue procedure 87 56 1987 2 cb 674.

For example if you classify a 10 000 roof expense as a repair you get to deduct 10 000 this year. The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the irc or the alternative depreciation system provided in section 168 g. Because you can deduct the cost of a repair in a single year while you have to depreciate improvements over as many as 27 5 years. Resurfacing a parking lot or replacing portions of concrete in a parking facility may be capitalized for book purposes.

Please note that the tax court has recently ruled in favor of taxpayers that elect to expense cyclical. If the lot was partially paved and only parts need to be replaced then you likely have sufficient basis to treat it as an expense. See attachment for asset summary. A deduction for any vehicle if the deduction is reported on a form other than schedule c form 1040 or 1040 sr.

Depreciation on any vehicle or other listed property regardless of when it was placed in service.