Prevailing Wage Roofing Illinois

Prevailing wage section po box 44540 olympia wa 98504 4540.

Prevailing wage roofing illinois. Our staff will work remotely and will respond to your inquiries via email. Prevailing wages in illinois are regulated by the illinois prevailing wages act it s purpose is to ensure a wage of no less than the general prevailing hourly rate as paid for work of a similar character in the locality in which the work is performed shall be paid to all laborers workers and mechanics. It is the awarding authority s city town county district state agency or authority responsibility to ensure that a copy of the. The missouri prevailing wage law requires that all workers working on public works projects by or on behalf of state and local public bodies be paid the proper prevailing wage rate.

The wage and hour division whd is pleased to announce that online training is now available to assist all federal state and local contracting agencies with information on federal rules concerning prevailing wages and other labor law requirements. The labor research and statistics office which includes the prevailing wage unit and the occupational injuries and illnesses unit will temporarily close its office in line with the governor s stay at home executive order. The act also sets forth the record keeping requirements for a contractor or subcontractor and sets forth the obligations of municipalities and other public bodies to establish the prevailing wage as well as to notify in writing all contractors and subcontractors regarding the prevailing wage act when bidding and awarding contracts as well as. The prevailing wage act requires contractors and subcontractors to pay laborers workers and mechanics employed on public works construction projects no less than the general prevailing rate of wages consisting of hourly cash wages plus fringe benefits for work of a similar character in the county where the work is performed.

The prevailing wage rates are usually based on rates specified in collective bargaining agreements. Dls also determines whether the prevailing wage applies to a given public works project. Davis bacon act and service contract act online training for government contracting officials. Instructions for filing certified payroll reports.

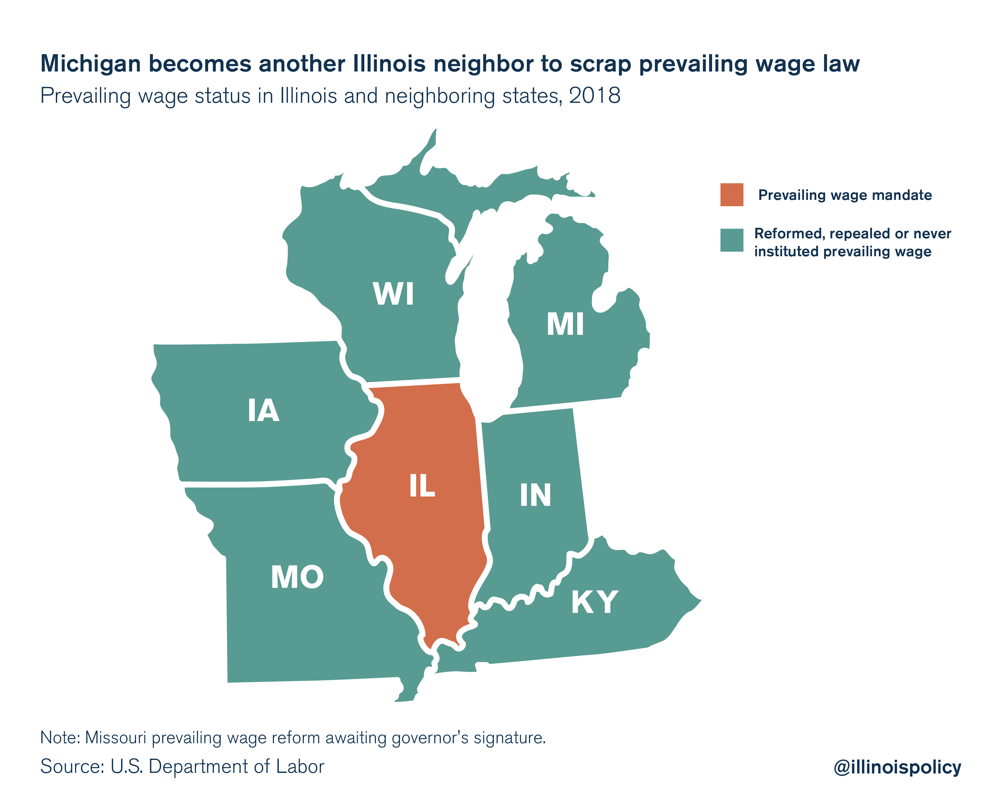

Prevailing wage rates are determined by actual hours worked for. The prevailing wage rate differs by county and for different types of work. Ohio s prevailing wage laws apply to all public improvements financed in whole or in part by public funds when the total overall project cost is fairly estimated to be more than 250 000 for new construction or 75 000 for reconstruction enlargement alteration repair remodeling renovation or painting. 32 states have prevailing wage laws on the books and illinois is one of them.